How Long Should I Wait for My W2

You may use that to prepare your tax return if it turns out that you cant get your W-2. The IRS sends over 9 out.

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

If you dont receive your W-2 by the W-2 Form Deadline ask your employer for it.

. 31 but it must be in. The official deadline for employers to distribute this tax document is Jan. Taxpayers should wait for the refund from their original tax return before filing an amended return.

When you are expecting a tax return it can be hard to wait for those W-2 forms to come in the mail. Grab your last 2021 pay stub and call the IRS at 1-800-829-1040 The IRS will ask you for some info before following up with your employer After notifying the IRS you can either continue waiting for your W-2 or paper-file. The IRS requires that they are in the mail by February 2 because January 31 falls on a weekend.

Aug 07 2014 A three weeks wait definitely beats a seven weeks wait. However Ive seen a lot of commercials recently from companies suggesting that they can help. The IRS has several ways of tracking your earnings via Form 1099.

Incidentally its kind of early. A dark line called linea nigra commonly appears down the middle of the abdomen. If youre expecting a refund you probably want it as soon as possible.

As others have said your last pay stub for the year contains all the information a W-2 has. The deadline for employers to send out W-2s is January 31. You can have a refund check mailed to you or you may be able to have your refund deposited directly into your bank account.

In about six to eight weeks from the date IRS receives your return. Usually most companies will send W2 tax forms on the last payday of January. Thank you I was able to get ahold of one of the two and they had my old address but typically my Mail gets forwarded when that happens they said they mailed it the 25th so even if it was re-routed I still feel like its been long enough I only live about 15 min from previous address 3.

Most taxpayers who file electronically and choose direct deposit will get their refund within 21 days assuming there are no problems with the return according to the IRS. Totally recommend trying this one out before spending money on others. Dec 17 2021 At 5 weeks pregnant your baby is the size of a sesame seed.

View solution in original post. Fortunately you dont have to wait too long. You can file your tax return without 1099 forms.

They should mail each tax years Form 1040-X in separate envelopes. The penalty for filing an incorrect W-2 with the Social Security Administration increases over time. The requirement for employers is that W2s must come out in the mail or make their W2s available online no later than January 31 st.

When your W-2 does come double check that your estimated numbers were correct. You can also check our database to find your W-2. This same deadline also applies to the 1099-MISC Form for non-employee compensation payments.

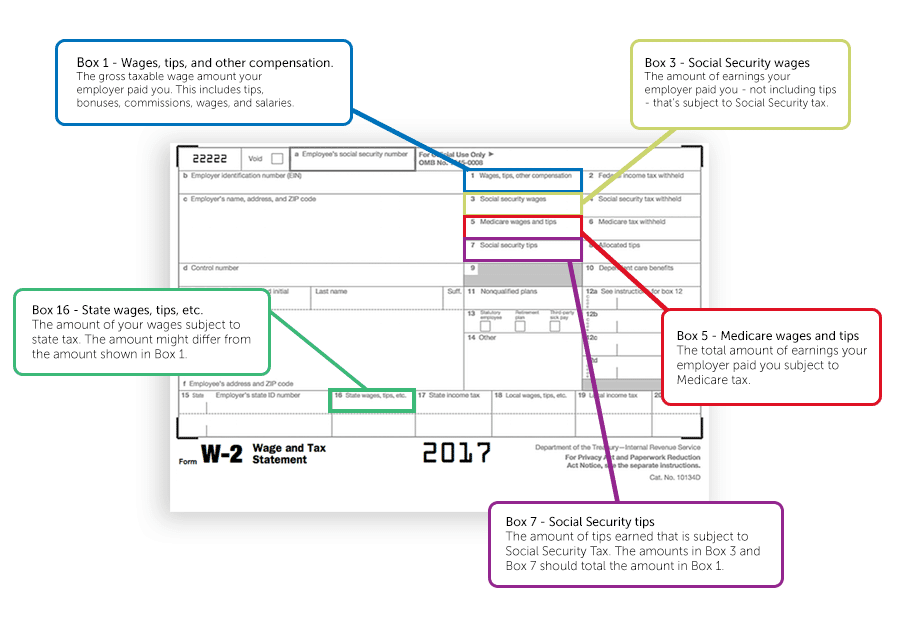

To avoid penalties a Form W-2c is generally required within 30 days of becoming aware of an error. The W-2 form shows your earnings the amount of taxes withheld from your paycheck for the prior year and other important items for filing your federal and state taxes. Typically the last forms to come in the mail are W2 forms from employers.

As the customer however there is very little you can do to influence the process. Heres what you need to know to predict how long youll wait for your refund. Only a single 30-day extension for the W-2 Form is.

31 delivery date requirement as long as it gets your W-2 in the mail by Jan. Regarding the W-2 Form Deadline your employer should issue W-2 Forms to you no later than Jan. If you file your return electronically your refund should be issued in less than three weeks even faster when you choose direct deposit.

Op 3 yr. My employer is taking their sweet time sending the W2. They seem to always wait until the last minute to issue them.

From what I understand the deadline by which they should have sent it. Thanks again and congrats on your. Taxpayers may not have their W-2 on Jan.

As with W-2 wage statements 1099 forms generally must be distributed to. There is a way that you. If you owe money you have the option to wait until April 15 to file your taxes and pay the IRS the money that you owe to them.

But technically your employer meets the Jan. How long will my tax refund take. The same delivery rule often applies to the many versions of the 1099 Form.

Anyone amending tax returns for more than one year will need a separate 1040X for each tax year. If you havent received your W-2 by February 14 its time to take action. The law requires your employer to mail your W-2 Form by January 31.

If a deadline extension is requested there are new requirements regarding this. This can be done online or you can send a check in the mail. How long should I wait before reporting.

What To Do If You Lost Your W 2 Gobankingrates

Wage Tax Statement Form W 2 101 Taxes For Expats

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

No comments for "How Long Should I Wait for My W2"

Post a Comment